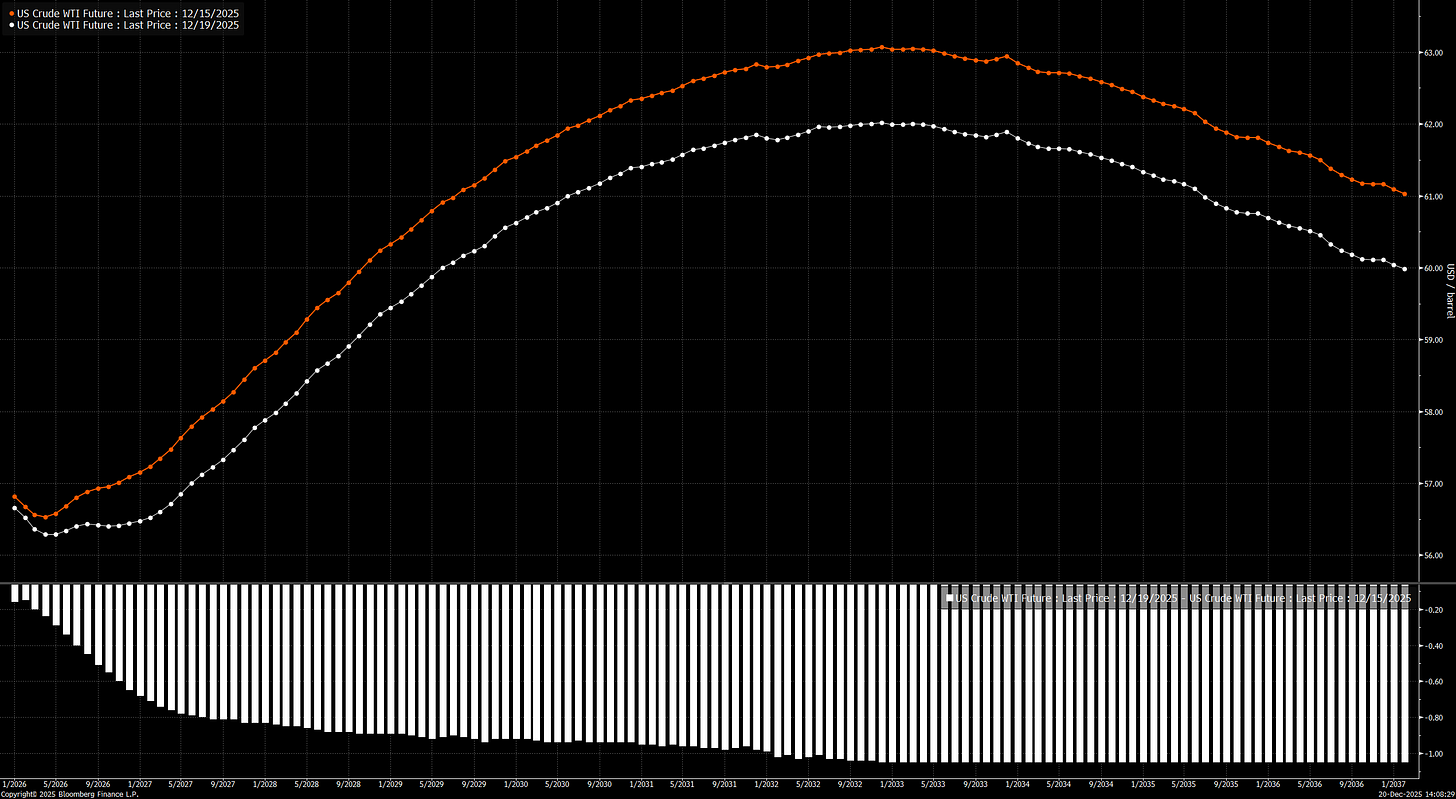

The Great Contango Delusion: Why Oil Markets Are Pricing in a Surplus That Does Not Exist

The oil futures curve you’re looking at represents one of the most profound mispricing events in commodity markets. Traders are pricing contango through 2032, which means they expect spot prices below forward prices for seven consecutive years. This structure only makes economic sense if there’s persistent surplus requiring storage, incentivizing producers to hold barrels for later delivery rather than dump them into oversupplied spot markets. The consensus view embedding itself in this curve assumes three things: OPEC can easily add 4 to 6 million barrels per day when needed, US shale will keep growing or at minimum hold flat production, and global demand growth remains anemic at under 1 million barrels per day annually.

All three assumptions are catastrophically wrong, and the curve will violently snap back into backwardation in H2 2026 when physical reality overrules paper market sentiment.